Everything about Which Type Of Bankruptcy Should You File

Everything about Which Type Of Bankruptcy Should You File

Blog Article

Facts About Tulsa Debt Relief Attorney Revealed

Table of ContentsA Biased View of Bankruptcy Attorney Near Me TulsaA Biased View of Tulsa Ok Bankruptcy SpecialistThe smart Trick of Top Tulsa Bankruptcy Lawyers That Nobody is Talking AboutGetting My Tulsa Bankruptcy Legal Services To WorkHow Experienced Bankruptcy Lawyer Tulsa can Save You Time, Stress, and Money.

The stats for the various other primary type, Phase 13, are also worse for pro se filers. (We break down the differences between the two key ins deepness listed below.) Suffice it to claim, speak with a legal representative or more near you that's experienced with personal bankruptcy regulation. Right here are a few resources to discover them: It's reasonable that you could be hesitant to spend for an attorney when you're currently under significant economic stress.Numerous attorneys also provide totally free appointments or email Q&A s. Benefit from that. (The charitable app Upsolve can assist you locate free appointments, resources and lawful help for free.) Ask if bankruptcy is certainly the appropriate choice for your circumstance and whether they think you'll qualify. Prior to you pay to file bankruptcy types and blemish your credit record for approximately 10 years, check to see if you have any type of practical choices like debt settlement or non-profit debt therapy.

Ad Currently that you've determined insolvency is certainly the right training course of action and you hopefully removed it with an attorney you'll need to get begun on the documentation. Before you dive right into all the main insolvency forms, you ought to get your own records in order.

How Tulsa Bankruptcy Consultation can Save You Time, Stress, and Money.

Later down the line, you'll really require to prove that by disclosing all type of info concerning your monetary events. Right here's a basic list of what you'll require when driving in advance: Determining papers like your motorist's license and Social Protection card Tax returns (approximately the previous 4 years) Proof of revenue (pay stubs, W-2s, independent earnings, revenue from possessions along with any type of earnings from federal government benefits) Bank statements and/or pension statements Proof of value of your possessions, such as car and real estate appraisal.

You'll want to recognize what type of financial debt you're attempting to solve.

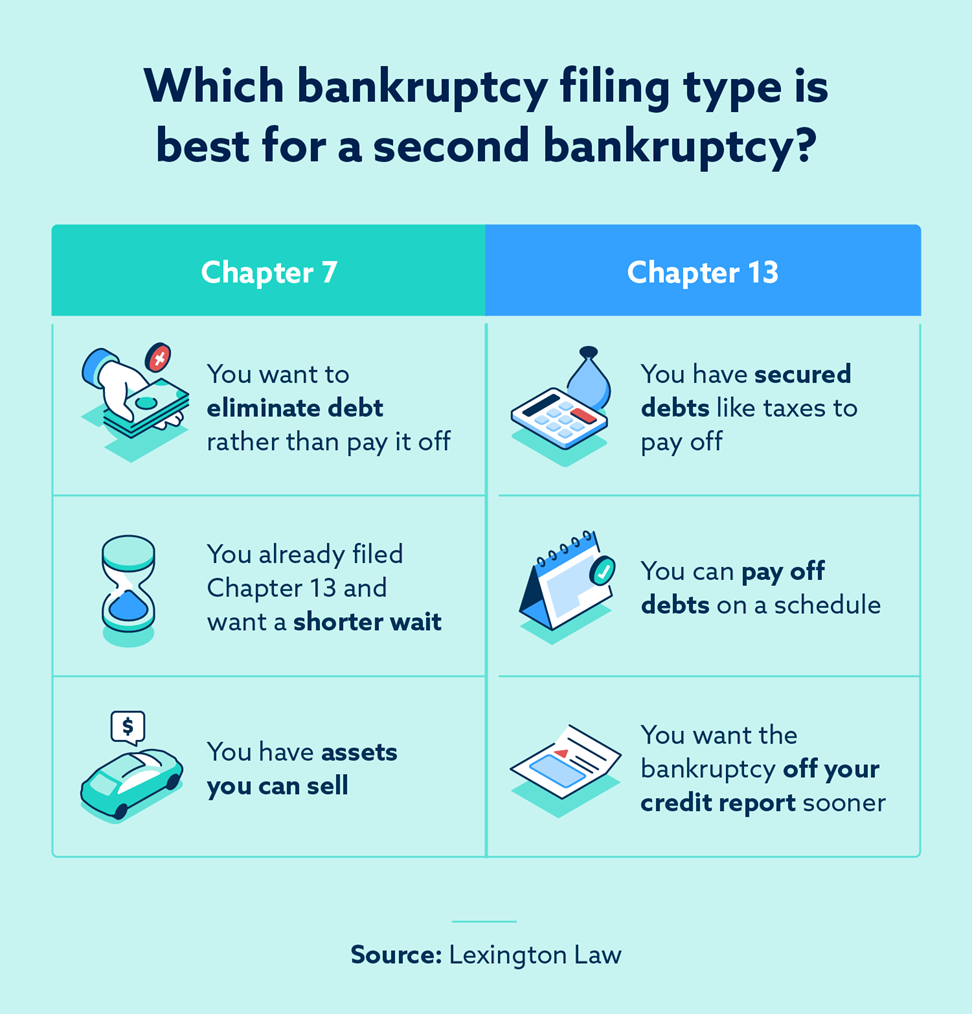

You'll want to recognize what type of financial debt you're attempting to solve.If your income is also high, you have another choice: Phase 13. This alternative takes longer to settle your debts due to the fact that it needs a lasting settlement plan generally three to five years prior to some of your remaining financial obligations are cleaned away. The filing procedure is also a lot extra intricate than Phase 7.

The Greatest Guide To Chapter 7 Vs Chapter 13 Bankruptcy

A Phase 7 personal bankruptcy remains on your credit rating report for 10 years, whereas a Chapter 13 insolvency drops off after seven. Both have long lasting impacts on your credit history rating, and any kind of brand-new financial debt you secure will likely include greater rate of interest. Prior to you send your insolvency types, you must first finish an obligatory course from a debt counseling agency that has actually been accepted by the Division of Justice (with the notable exemption of filers in Alabama or North Carolina).

The training course can be finished online, in individual or over the phone. Courses commonly cost in between $15 and $50. You should finish the training visit the website course within 180 days of declare insolvency (bankruptcy lawyer Tulsa). Utilize the Division of Justice's web site to locate a program. If you reside in Alabama or North Carolina, you have to select and finish a program from a list of individually authorized carriers in your state.

Bankruptcy Law Firm Tulsa Ok Things To Know Before You Buy

Examine that you're filing with the right one based on where you live. If your long-term residence has actually moved within 180 days of loading, you should file in the district where you lived the better section of that 180-day duration.

Typically, your insolvency attorney will deal with the trustee, however you may require to send out the person records such as pay stubs, tax returns, and financial institution account and credit scores card declarations straight. The trustee that was simply selected to your instance will soon set up a necessary meeting with you, called the "341 conference" due to the fact that it's a requirement of Area 341 of the U.S

You will need to give a timely list of what qualifies as an exemption. Exemptions may put on non-luxury, primary lorries; necessary home products; and home equity (though these exceptions regulations can differ commonly by state). Any type of building outside the list of exceptions is taken into consideration nonexempt, and if you don't give any list, then all your residential or commercial property is taken into consideration nonexempt, i.e.

You will need to give a timely list of what qualifies as an exemption. Exemptions may put on non-luxury, primary lorries; necessary home products; and home equity (though these exceptions regulations can differ commonly by state). Any type of building outside the list of exceptions is taken into consideration nonexempt, and if you don't give any list, then all your residential or commercial property is taken into consideration nonexempt, i.e.The trustee wouldn't market your sporting activities automobile to instantly pay off the lender. Instead, you would pay your creditors that quantity throughout your layaway plan. A common mistaken belief with personal bankruptcy is that as soon as you submit, you can quit paying your financial debts. While insolvency can aid you eliminate most of your unsecured debts, such as overdue medical bills or individual car loans, you'll wish to maintain paying your regular monthly settlements for guaranteed financial obligations if you wish to maintain the building.

The Ultimate Guide To Tulsa Debt Relief Attorney

If you're at danger of repossession and have actually exhausted all various other financial-relief alternatives, after that applying for Phase 13 may delay the repossession and assist in saving your home. Ultimately, you will still need the revenue to continue making future mortgage payments, along with settling any late settlements throughout your settlement plan.

The audit could delay any type of financial debt alleviation by a number of weeks. That you made it this far in the process is a good indicator at least some of navigate to this web-site your debts are eligible for discharge.

Report this page